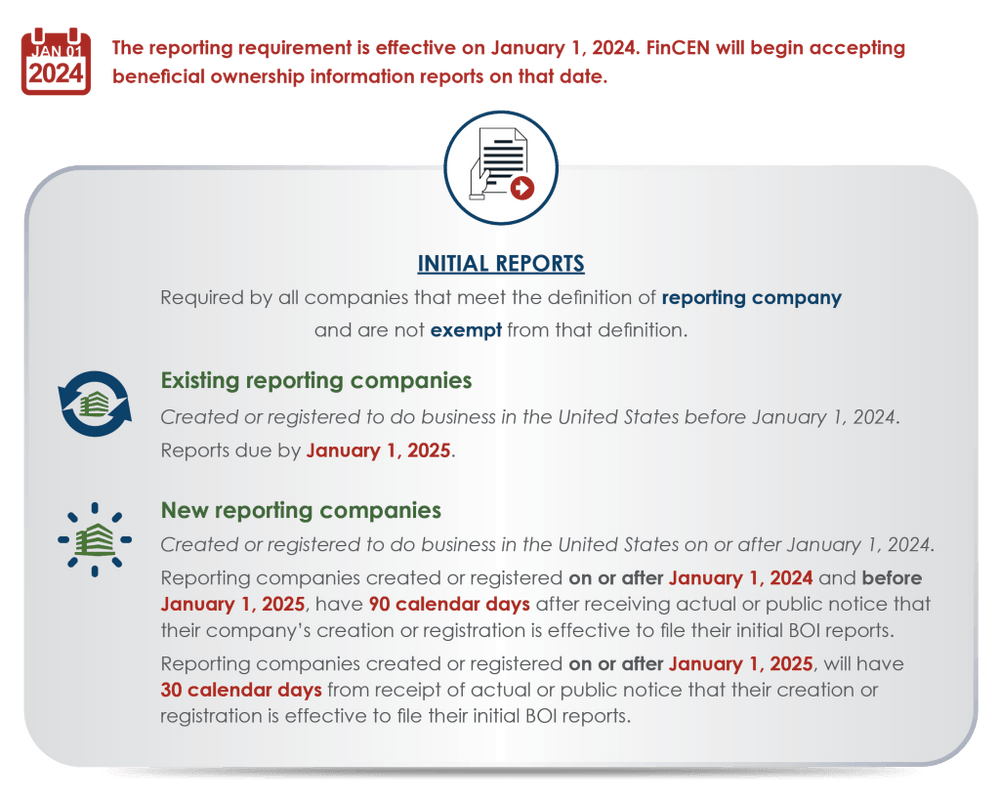

Beneficial Ownership Information Reporting is the new tax filing that can turn your $300 LLC into a $10,000 fine or jail!

Which of your businesses does it apply to, and how do you stay legal?

In plain English with links and pictures.

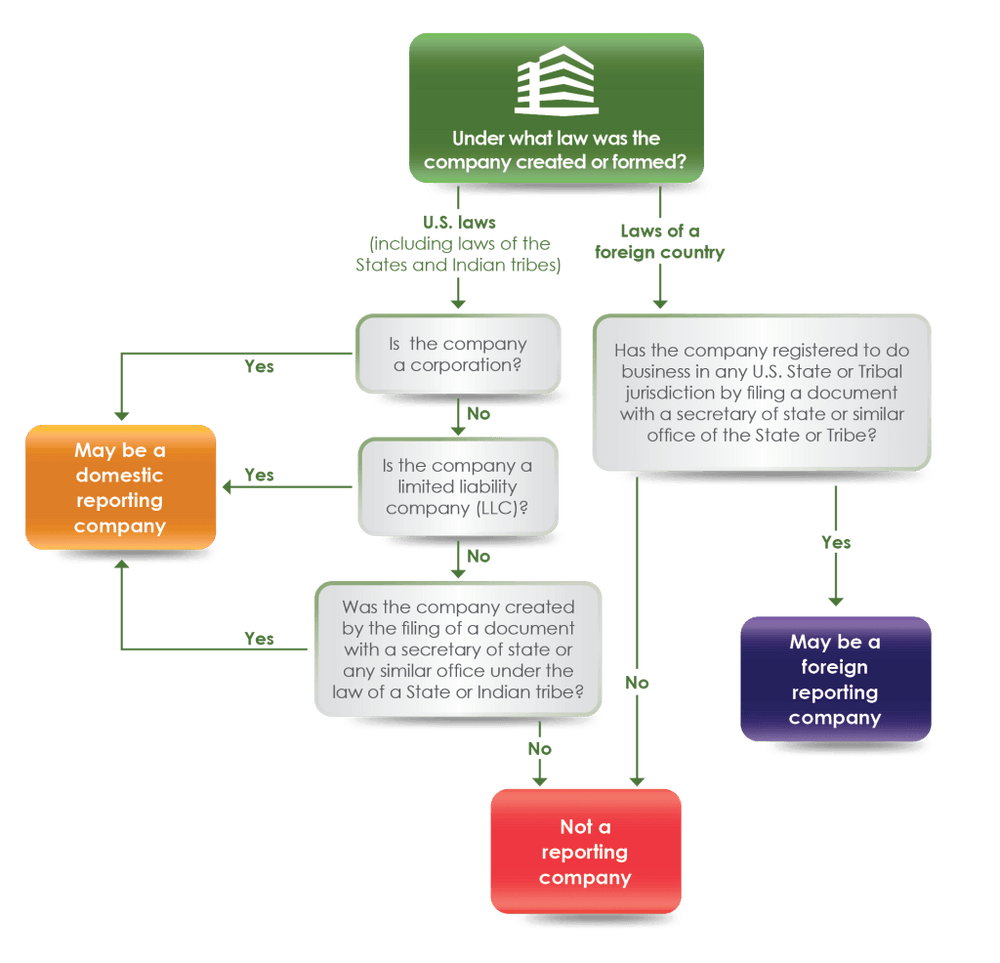

In general, think LLCs, Incs, LPs, and GPs that are under 20 employees or $5MM in revenue.

Think start-ups, sole proprietors, and non-SEC registered investment LLCs.

If you are a solopreneur or SMB, this is likely you!

(See also: Who has to file beneficial ownership information?)

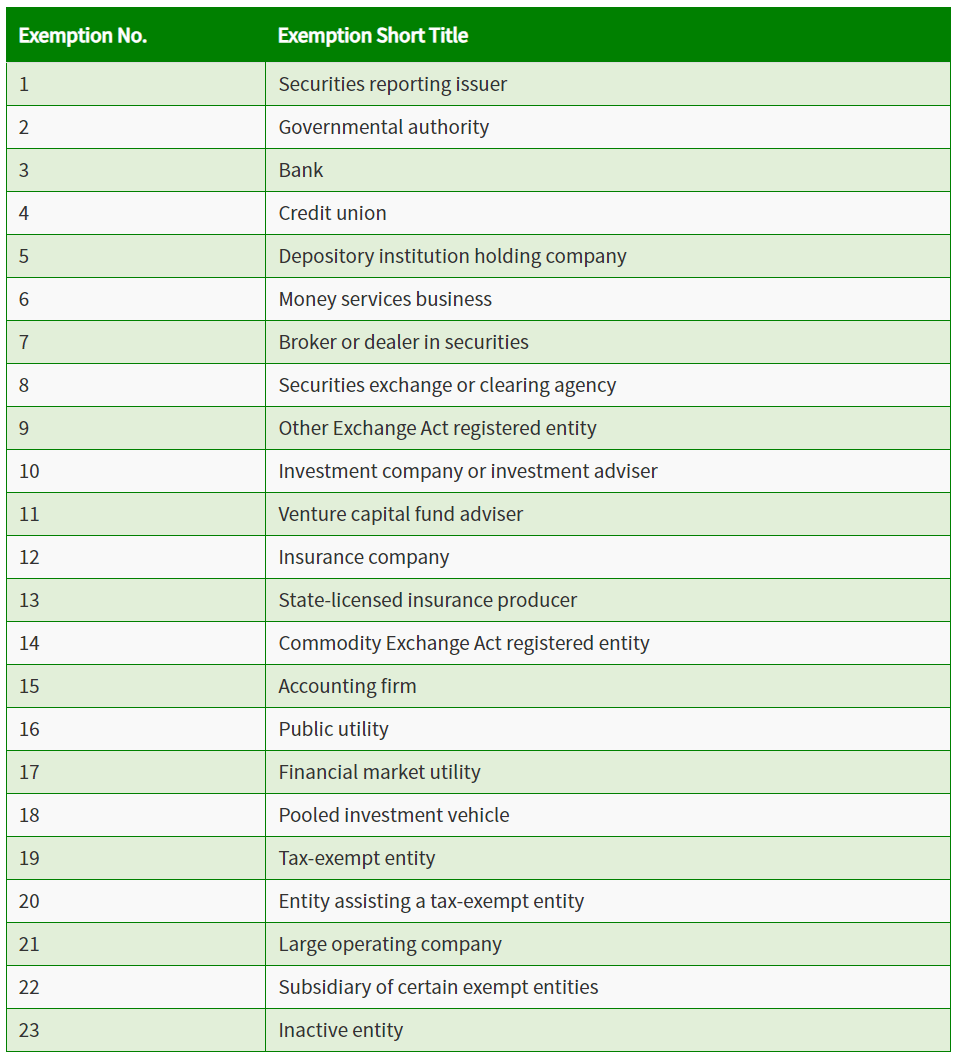

FinCEN identifies 23 exceptions, but we can group them into 8 categories.

Top 3 exception categories:

Other 5 exception categories:

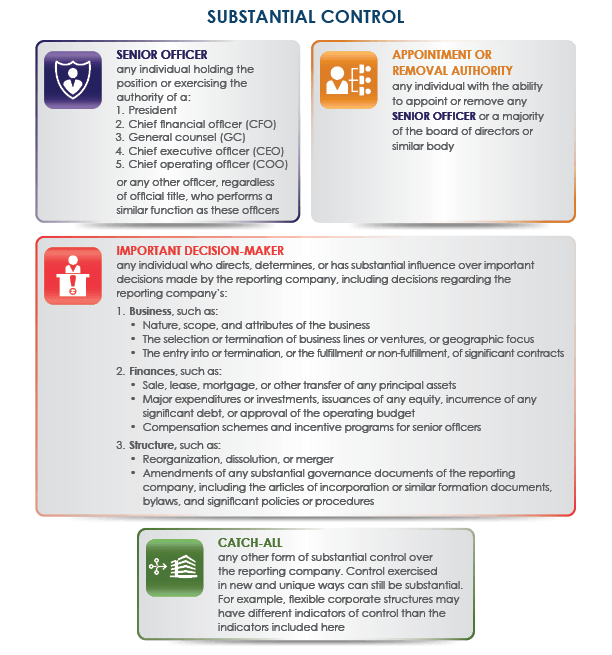

An individual who either:

Exceptions: minor children, non-senior officer employees, nominees, or agents.

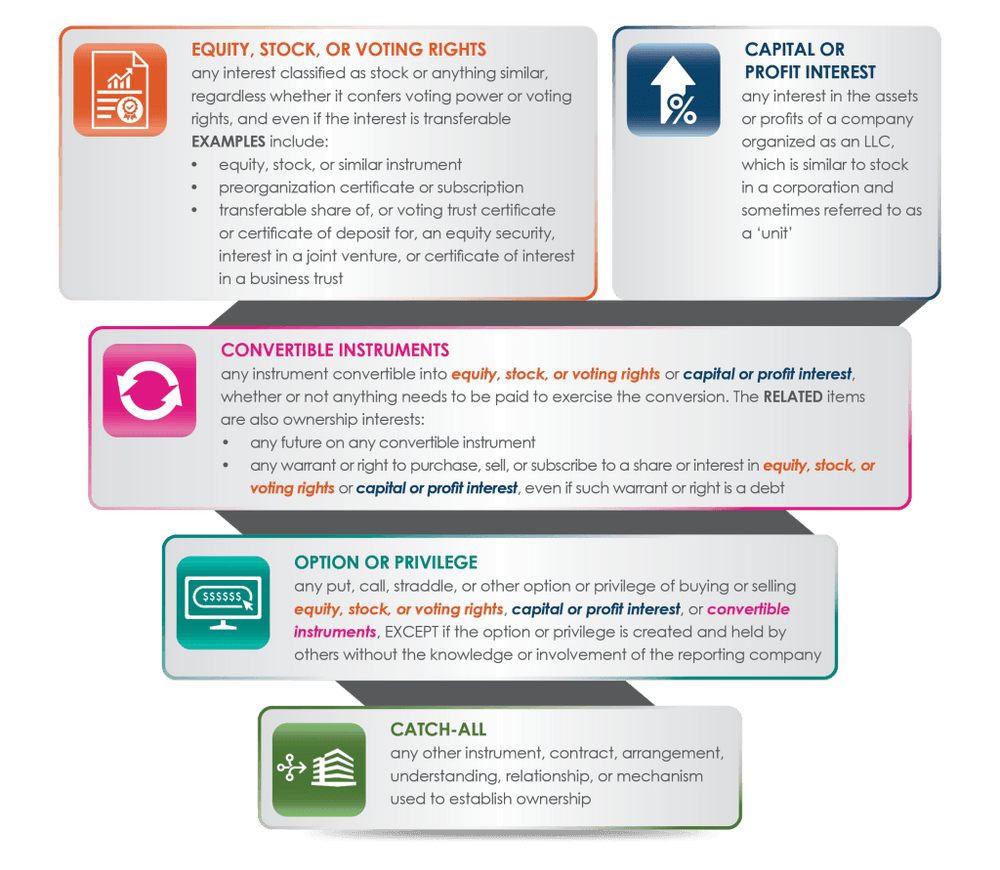

Examples given by FinCEN:

Essentially everything - examples include:

If your business:

The form to report beneficial ownership information is not yet available. Once available, information about the form will be posted on FinCEN’s beneficial ownership information webpage.

OR pre-file with ComplyBOI.com now and eliminate the worry and risk of non-compliance by using our easy and accurate report filing services.

Eliminate your worry and risk of non-compliance by using our easy and accurate report filing services.